Many of us feel like outsiders when it comes to the world of wealth—like there’s a secret playbook the privileged know from birth. The truth? It’s less about secret knowledge and more about understanding the fundamental differences between assets and liabilities.

For those of us not schooled in the subtle arts of finance, the pathway to prosperity can seem labyrinthine. The typical response? We ensnare ourselves in jobs that promise little more than staying afloat—embracing the grind that barely keeps us “Just Over Broke.”

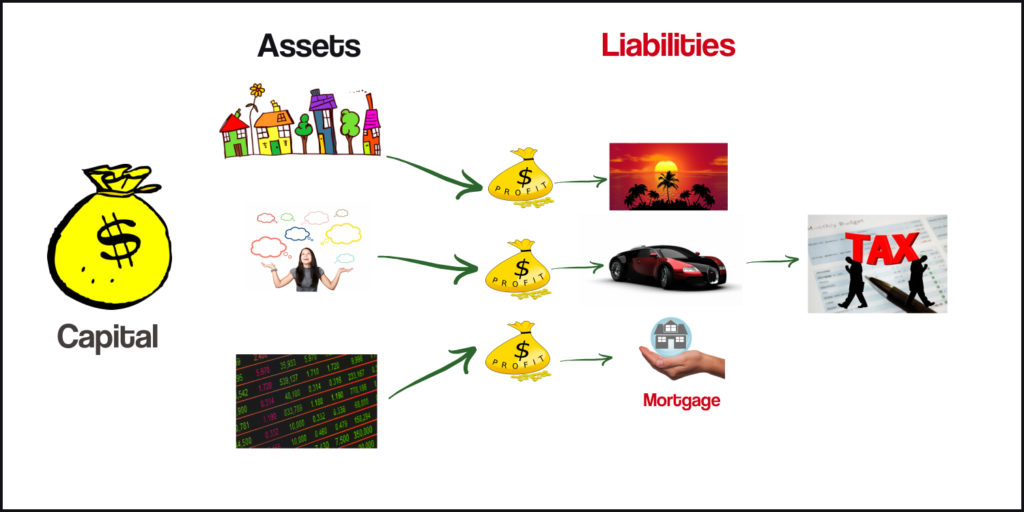

But what if you could shift from enduring the financial rollercoaster to designing a landscape of steady, accruing wealth? Assets are your tools—whether a rental property, a small business, or intellectual property like a book. These are not just investments; they’re creations that can perpetually generate income with minimal ongoing effort. Understanding this is your first step away from the precarious edge of financial uncertainty.

Historically, the opportunity to build and accrue assets has seemed a distant dream for many who are less affluent—those for whom daily survival and immediate needs like putting food on the table take precedence over long-term financial strategies. Often, these individuals have found themselves with little to no disposable income to invest, and the world of asset-building appeared gated, reserved for those already ahead financially.

My aim is to dismantle those barriers. I am dedicated to revealing how you can begin to build valuable assets from nearly nothing—“out of fresh air.”

With minimal capital and without the need for extensive prior financial knowledge, I provide step-by-step guidance to empower you to take control of your economic future. This is not about budgeting or managing your finances better; I wouldn’t dare try to tell you how to run your life!

No, this is about turning modest beginnings into real, tangible assets that grow over time and have the ability to make money for you and your family.

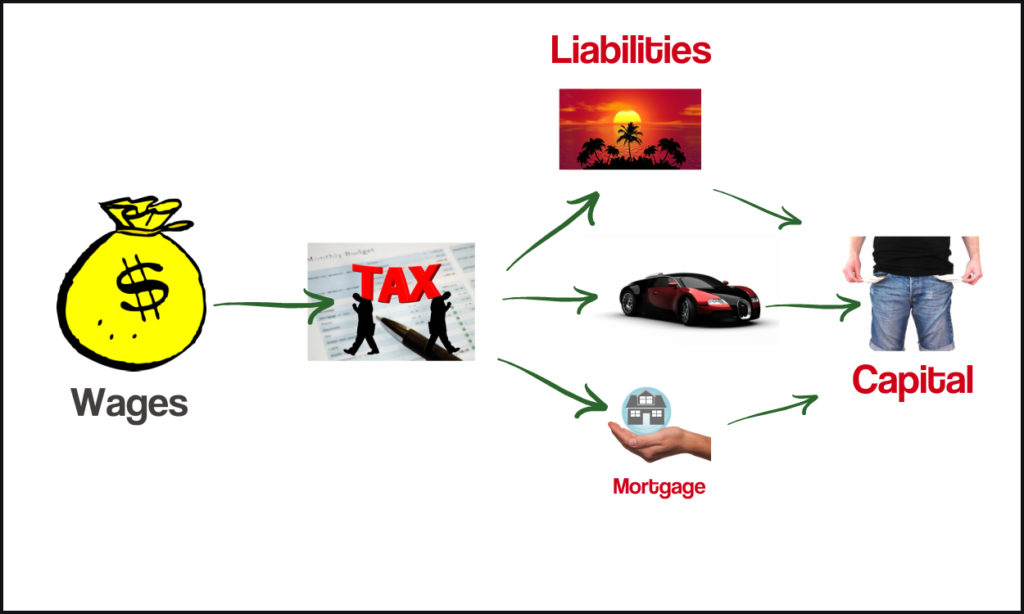

In contrast, liabilities are the silent adversaries in this game, continuously draining your resources—things like car payments or credit card debts, which are even more burdensome because they consume already-taxed income.

And what about those sudden windfalls—like a lottery win that seems more curse than blessing? Without a clear understanding of asset versus liability, such fortune quickly morphs into misfortune, as ephemeral luxuries drain what should have been a lasting boon.

Moreover, the concept of ownership often traps us in a cycle of insecurity and debt. Ownership is a myth we’re sold, a myth that burdens rather than liberates. Consider the wealthy who leverage assets to enjoy luxuries as tax-efficient expenditures, rather than draining their capital.

It’s not just about making money; it’s about rewriting your financial narrative. The rich don’t simply work harder; they let money work smarter for them. This site, and the resources I recommend, are your starting blocks. I don’t just aim to equip you with financial tools. I aspire to transform your entire financial paradigm, showing you how to cultivate your assets and redefine what it means to be wealthy.

Start this transformative journey with me today. Let’s demystify the financial strategies of the wealthy and make them accessible, turning what seems like privileged secrets into common knowledge. It’s time to bridge that gap and pave your path to true financial freedom.

Start Here and see what resonates